|

|

FICO Score A FICO credit score is a three-digit number generally ranging from 500−850. The higher your score, the better credit risk lenders think you are. And that means you'll pay lower interest rates on loans and insurance. The number can go up and down based on the way you handle your financial commitments. |

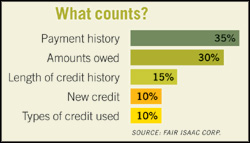

According to FICO, the breakdown of a person's score is as follows:

- 35 percent of the score is determined by payment histories on credit accounts, with recent history weighted a bit more heavily than the distant past.

- 30 percent is based on the amount of debt outstanding with all creditors.

- 15 percent is produced on the basis of how long the borrower has been a credit user (a longer history is better if there have always been timely payments).

- 10 percent is comprised of very recent history and whether the borrower has been actively seeking (and getting) loans or credit lines in the past months.

- 10 percent is calculated from the mix of credit held, including installment loans (like car loans), leases, mortgages, credit cards, and so on.

| Your FICO

Score----------Interest Rate 720 - 850 Excellent---------- 6.089% 700 - 719 Good---------------- 6.214% 675 - 699 Fairly Good------- 6.751% 620 - 674 Average------------ 7.901% 560 - 619 Poor----------------- 8.531% 500 - 559 Bad------------------ 9.289% |

These are not today's rates. They are an actual example of the rate spread between high and low scores. |

Among the things that lower your FICO score:

- Delinquent payments

- Opening too many accounts during a 12-month period

- Carrying the maximum balance (or nearly so) on revolving credit cards

- Tax liens, judgments, bankruptcy, foreclosure

- Too many credit inquiries (other than shopping for mortgages and car loans)

- Loans from finance companies

- No credit history

- Errors that need correcting

Get your FICO

Score and your Credit Report

Until recently, one's FICO score was a deep, dark secret, known only to

the credit bureaus and lenders. Starting a couple of years ago, however,

FICO scores became public—in fact you can get yours (along with your

credit report) from the three major credit bureaus or directly from FICO

or here is a free site AnnualCreditReport.com

The three credit bureaus and FICO charge a modest fee, typically $9-12, for sending out reports. Spend the money and get copies from all three—each can different errors. Order your report three to six months before applying for a mortgage—you want plenty of time to correct any errors and avoid being turned down. Being turned down also goes into your report—it's a black mark.

The three major credit bureaus are:

1. Equifax: 800-685-1111

2. Experian: 888-397-3742

3. TransUnion: 800-888-4213 or 800-916-8800

Getting a Free Copy of

your Report

Check your free credit reports at least once a year at each credit

bureau to ensure that fraudulent accounts have not been opened in your

name. (Requests can be staggered to provide a report once every four

months.) There are three ways you can get a free copy of your credit

report:

- You can get one free credit report a year at AnnualCreditReport.com or 877-322-8228

- If you've been turned down for credit. The lender who said "no" is required by law to tell you which bureau provided negative information. The bureau, in turn, must give you a free copy of your report—but only for 60 days.

- You can also get a free report if you are unemployed or on public welfare or you believe your file contains bad information as a result of fraud.

What's Inside your

Report

You'll find your credit report includes extremely detailed information

on whether you pay your bills on time, what credit you have applied for,

who has given you credit, who has turned you down. Your history of

repaying bank loans, utility bills and the government will also be

there.

Your credit report lists the following information for each of your credit accounts:

* Date opened

* Original loan amount or credit limit and interest rate

* Scheduled monthly payment amount

* Date last payment was made

* Balance owed

* Amount past due

* Payment history for the last 24 months

Credit inquiries from companies that have checked on your credit are also listed—these give potential lenders an idea of how much credit you have sought, successfully and unsuccessfully.

Make sure the following basic facts are correct; mistakes can simply be the result of spelling errors, typos, outdated information, or name confusion. Paid and settled balances are frequently missed by one of the 3 agencies.

* Your name—if you've married or divorced and changed your name, the correct name should be recorded; if accounts you never held jointly with an ex-spouse appear on your report, request that this information be removed

* Your date of birth

* Your Social Security number

* Current and previous addresses

* Current and previous employers

* Current accounts

* Accounts that were closed

Also check to make certain no items are in your report longer than the law allows. If you declared bankruptcy, that fact must be removed from your credit history after 10 years, but a deficiency judgment on a foreclosure can be renewed for another 10. Information pertaining to arrests, tax liens, suits and judgments must be removed after 7 years. Minor infractions, like a missed payment or a payment over 30 days late, stay on your report for seven years.

Correcting Mistakes

If you find errors in your credit report, contact the credit bureau that

issued the report in writing. The bureau cannot ignore you—the Fair

Credit Reporting Act requires credit bureaus to look into all

disputed items within 30 days unless it considers your dispute

"frivolous." More specifically, the credit bureau must

investigate any errors you raise with the bank, credit card company or

organization that supplied the data to the bureau.

If the creditor agrees that you are correct, the bank or credit card company must notify all nationwide credit bureaus so the information in your file can be corrected. You can also request that the credit bureau send notices of all corrections to anyone who received your report during the last six months.

If you do not agree with the results, you can file a 100-word written statement, giving your opinion. This statement must be included each time your report is requested in the future.

You'll find sample letters and other important details spelled out very clearly on the FTC's website. Take time to read this information. It will help you file a strong case.

10 Ways to Clean up

your Act

You'll also need to do some additional damage control and begin to

rebuild your credit history. It won't be easy and it will take

willpower, but if you're determined to get a mortgage and buy your dream

house, you can do it.

1. Pay your bills on time. Make at least the minimum payment. You'll avoid late fees and at the same time repair your credit health—a new pattern of prompt payments will eventually overtake your previous negative pattern. I have the minimum payment, or more, automatically deducted from my checking account so I don't accidentally incur late fees or dings on my credit score if I get distracted.

2. Contact your creditors. Do so immediately if you cannot make a payment on time. Negotiate a new payment schedule. If you missed a payment to a creditor awhile back, but now you're up to date, you can try asking them to remove this negative information from your credit report.

3. Reduce the number of credit cards you use. Mortgage lenders look at your credit lines as a potential for going on a credit card spending spree. The more cards in your pocket, the larger your potential for disaster. But don't close the oldest cards altogether, older accounts with unused credit help your score.

4. Pay off the total balance on high-rate accounts. This will end having to make high monthly payments and free up money to save for a down payment.

5. Pay off your highest rate cards first. This way you'll save the most amount of money and get out of debt more quickly. But don't close the oldest cards altogether, older accounts help your score.

6. Track your debts. Non-mortgage debt payments should never be more than 10% to 15% of your monthly take-home pay.

7. Keep inquiries to a minimum. Each time you authorize a lender, creditor or other business to check your credit report, an inquiry is added to your file. A large number of inquiries within a short time period may send up a red flag—that you're applying for too much credit because you're having financial problems or you're taking on more debt that you can pay off. Note: Queries within a few weeks for one type of credit — say, a car loan or a mortgage will be grouped as one. Creditors know you are likely to shop multiple sources.

8. Switch to a secured credit card. If you cannot get credit or you cannot stick to a prompt payment plan, get a secured card. Because it is linked to your bank savings account, you can withdraw only up to the amount in that savings account.

9. Put off buying big ticket items. The new refrigerator or sofa can wait until you've bought your new home at a lower interest rate.

10. Pay for everyday items with cash. Don't pay for your groceries with your credit card. It's much too easy to spend more than you have budgeted ...and you could wind up paying interest on your quart of milk and loaf of bread. Keep the balance under 30% of your limit to earn top scores.

More Information:

If you're in serious trouble and need one-on-one help, contact the

nonprofit National Foundation for

Credit Counseling at 800-388-2227.

The foregoing adapted from an article by

Nancy Dunnan, New York-based financial advisor and analyst who

specializes in helping people with credit issues

Learn more about Nancy. More

advice from Nancy:

* Seven ways to save for your down payment

* Homeownership for singles

* Tips for first-time home buyers

New FHA Guidelines

After Mortgage Default

FHA

wants to encourage buyers back into home ownership. To

participate

in their program and have the standard three-year post-default waiting

period reduced, borrowers must meet specific eligibility criteria to

qualify for a new FHA mortgage:

- Take one hour of counseling from an approved Housing and Urban Developing (HUD) counseling agency at least 30 days before beginning a loan application.

- Bankruptcy, foreclosure, deed-in-lieu, short sale or delinquencies discharged, for at least 12 months.

- Document the financial hardship that lead to the mortgage default (a written job termination notice or other documentation of job loss, and W2s and/or signed tax returns to verify loss of income

- Show at least a 20% reduction in household income for at least 6 months prior to their loan default. (Under the HUD program, household income is defined as the income of a borrower and co-borrower that was used to obtain the defaulted mortgage.

- Re-established good, on-time credit for at least 12 months after the default, via new or re-established credit accounts

![]()

This

page presented as a service to homebuyers by Richard

Webb, Top Producer

This

page presented as a service to homebuyers by Richard

Webb, Top Producer Contact

the WEBBmaster for updated details, and help selling, or finding the

perfect home or commercial location. About

Richard Webb

Contact

the WEBBmaster for updated details, and help selling, or finding the

perfect home or commercial location. About

Richard Webb

cel/text 321-480-5514

eMail webb@4Brevard.com

Skype videoPhone: webb4Brevard

©2007-2016

Improve

Your Credit Score &

Improve

Your Credit Score &