REPUDIATE THE DEBT NOW!

|

Repudiate (default on) the national debt and start again, just like bankruptcy. Inflation, widely acknowledged as inevitable, is an immoral penalty on savers.

Vladimir Lenin said “The surest way to overthrow an established social order is to debauch its currency.”

So I offer this heretical and logical alternative – DEFAULT.

You cannot solve a problem till you admit you have one, and dig out its roots – in this case corruption. Politically-connected crooks like Jon Corzine at MF Global stole our kids' heritage just as surely as 1960's Watts rioters ran out of stores with color televisions. The big difference is the politicians, in order to buy votes, figuratively carried gold bars out of Fort Knox and enabled their Ruling Class friends to do likewise. Then they borrowed more, and stole that too! We cannot get the money back, so repudiate the Ruling Class, repudiate Progressivism, repudiate their statist paradigm, repudiate their debt, and start over. Next time, follow the Constitution.

|

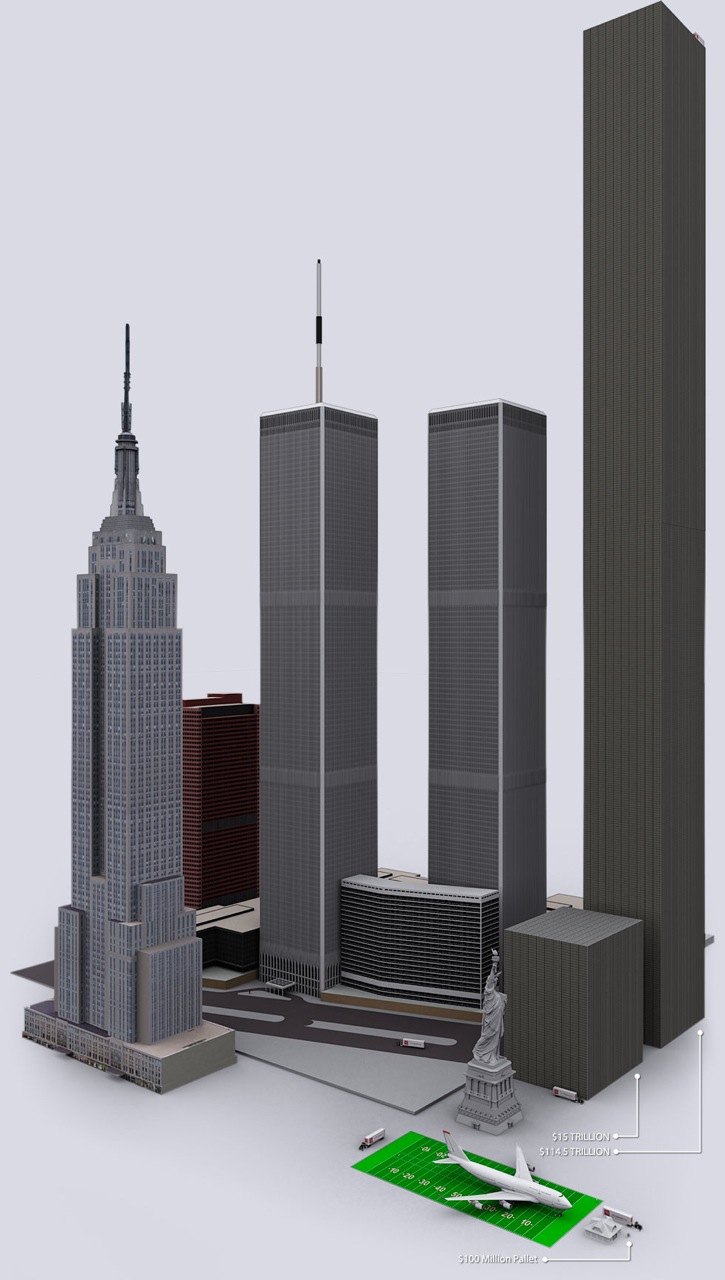

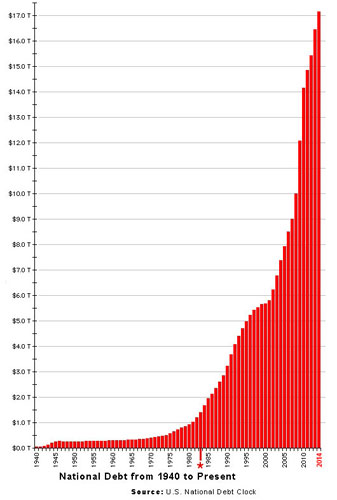

The

IMF Selected

Issues Paper pronounced us bankrupt in July 2010. U.S. admitted debt

then stood at $14 trillion, plus unfunded liabilities bringing us to

about $202 trillion in total and rising fast according to Boston

University economist Lawrence

Kotlikoff. Nevertheless, politicians keep spending money to

buy votes and bail out their contributors. America's debt is the obvious

result of total FAILURE of the “Progressive” (actually regressive)

agenda! Studying Lenin's plan for communism, and watching the Treasury

and Federal Reserve, one might

logically conclude that Progressives want to deliberately collapse our

economy, and implement one world currency. First CONgress

increases the debt, then the Federal

Reserve creates money to buy the debt and keep interest rates

artificially low in a counterfeiting alchemy called monetization or

"quantitative easing". This floods the world with worthless

paper (fiat) and makes every previous dollar worth less.

The

IMF Selected

Issues Paper pronounced us bankrupt in July 2010. U.S. admitted debt

then stood at $14 trillion, plus unfunded liabilities bringing us to

about $202 trillion in total and rising fast according to Boston

University economist Lawrence

Kotlikoff. Nevertheless, politicians keep spending money to

buy votes and bail out their contributors. America's debt is the obvious

result of total FAILURE of the “Progressive” (actually regressive)

agenda! Studying Lenin's plan for communism, and watching the Treasury

and Federal Reserve, one might

logically conclude that Progressives want to deliberately collapse our

economy, and implement one world currency. First CONgress

increases the debt, then the Federal

Reserve creates money to buy the debt and keep interest rates

artificially low in a counterfeiting alchemy called monetization or

"quantitative easing". This floods the world with worthless

paper (fiat) and makes every previous dollar worth less.

Hyperinflation – Where We're Headed

|

Economist Milton Friedman described inflation as "too much money chasing too few goods". Gradual inflation is far more politically palatable than honest money, or default. People falsely equate rising prices with prosperity and do not understand how the ravages of inflation penalize conscientious savers who worked their whole lives to build a retirement and invest it wisely. Inflation is simply a statist scheme for the confiscation of savers wealth. As prices go up, millions of American's savings get wiped out by surreptitious theft. It starts gradually as in the 1970's, but due to unimaginable debt, this round will result in hyperinflation where prices change hourly, as they did 36 times in the 20th century (Germany 1919, China 1935, Hungary 1945, Bolivia 1985, Brazil 1986, Zimbabwe 2008, etc.). Constitutional patriots cannot allow our country to slide down that same path to ruin. Rogue governments print money to cover their extravagance until they are STOPPED, just like irresponsible borrowers run up credit cards till the bank says "No more".

Default – A Rational Alternative

Instead of allowing inflation to wipe out the savings of wise Americans and innocent American taxpayers for generations to come, let the burden fall on those who made foolish unsecured loans. Let the default impact where it should – on irresponsible fools worldwide who lent to an obviously rogue government.

It was a lie when you were told we owe the national debt to ourselves. Only 14% is held by households, 33% by domestic financial institutions. We owe it to the banksters, the Sheiks, the Chinese who made billions selling us their products. They lent us more money to pay for irresponsible social programs that undermined our productivity (lulling people into a sense of entitlement rather than working) so foreigners could manufacture and sell more stuff. Enemies of freedom financed our decline in a strategic gambit to own us rather than fight us. Don't let them win by foreclosing on our national heritage.

Repudiation Benefits

There are five long-lasting benefits to repudiation.

1. Invigorate Lending Banks currently refuse to lend to productive business partly because of an honesty crisis in accounting rules, and partly because they think they are getting a nice risk-free spread between the artificially low Fed Funds rate at which they borrow money, and the "guaranteed" return on government securities. Voters discussing government default will re-mold investor thinking and make business lending more attractive than government lending. Just the DISCUSSION of repudiation will drag money out of socially unproductive lending to government, and free that money for business-use which creates jobs.

"Jobless recovery" is an oxymoron. You cannot recover without jobs. Anyone who has surrendered the job hunt is not counted in unemployment, an obvious fantasy. Admitted unemployment: 9.6%; Real unemployment: 16.7%. The only meaningful economic goal is full-time JOBS, and enabling everyone's productive capacity to reach increasingly higher levels. ALL economic activity traces back to jobs and production.

Coupled with productivity-enhancing innovation, the more people in productive jobs, (not government jobs and not jobs serving government like tax accountants and lawyers), the greater America's ability to compete globally. Each person allowed or forced to remain idle, sucking productive capacity out of the country, is a drag on our Gross Domestic Product.

By the way, when the term GDP or GNP was invented, the non-productive government-serving jobs were negligible. Now the Government Sector should be factored out of productivity measurements lest we delude ourselves into counting government as productive. It clearly is not, but we can lay aside the concept of how to measure government as counter-productive for another discussion.

2. Restrain Government Borrowing Since governments are unwilling to curb their penchant for spending to buy votes, taxpayers must restrain government's immoral borrowing ability by inducing lenders to cancel their credit card. We must reintroduce the accountability inherent in having to tax someone today, to pay today's bill. The downward spiral induced by profligate borrowing and building palaces to bloated inefficient kleptocracies like the Departments of Education and Energy will stop when the money stops flowing. If government cannot borrow, it cannot pass the bill to the next election cycle, or to our great-grandchildren. Lines drawn in the sand get washed away. Arrogant vote-buying thieves in Washington possess no economics education, yet think they can constantly make up new rules to thwart the laws of economics. Draw this line in concrete -- NO more borrowing to buy votes.

Government borrowing sucks money out of credit markets so there is none left to fund business expansion. Business MUST have reliable credit at reasonable rates so they can commit to the expansion that creates new jobs.

3. Preemptively Rescue Our National Assets and Treasure From the International Monetary Fund Brazil's experience with the IMF is instructive. The IMF modus operandi worldwide is to help countries get into financial trouble, then "rescue" the country with secured loans, then foreclose and take the assets. The worldwide perception is this: Greedy American bankers use a ruse called the "Washington Plan" to steal their assets. But the reality is – the IMF has no allegiance to the United States. They only seek control. Indebted countries lose choices over their economic and political future, freedom is sacrificed. Their economic surplus gets pledged to IMF as financial tribute. Without the overhead costs of a military occupation, states relinquish their policy-making from elected representatives to the new Central Planners thru secretive financial deals. IMF will just as quickly snatch assets controlled by the U.S. Government (GM stock, millions of homes owned by Fannie & Freddy, land in the Grand Canyon and Mississippi River Delta, or Hoover Dam) as they foreclosed on Brazil's Amazon River Basin – another victim of the New World Order.

4. Re-Establish Accountability The free-market system is based on lots of people making small decisions in their enlightened self-interest, which when taken in aggregate, creates freedom and prosperity. Insurance, in addition to pooling risk so nobody takes a catastrophic hit, tends to make the insured less diligent, less careful, more prone to wild risk-taking. In the case of launching an expensive satellite, enabling risk-taking yields societal benefits. Conversely, in the case of homeowner's insurance, the owner is less concerned about a decaying tree falling on his house. In the case of banking, the depositor is less likely to investigate the bank's balance sheet, assuming FDIC insurance will protect him. In investing the lender is less likely to investigate the possibility of default if Fannie Mae or Freddy Mac (backed by taxpayers) insures the loan. Likewise, buyers of Treasury instruments do not exercise diligence in evaluating the possibility of default on unsecured government obligations, deluding themselves into thinking the taxpayers will always make good on CONgress' profligate spending. Investors should not ass-u-me someone ELSE will pay for political recklessness.

5. Save our Currency Our currency is based on nothing but the full faith and credit of the United States, in other words, our government's ability to rob and extort money from present and future taxpayers. Already the IMF cajoled Brazil, Russia, India, China, and others to dump our currency and substitute IMF Special Drawing Rights (SDRs) as the worldwide medium of exchange because they expect extreme inflation. Russia and China agreed in October 2010 to quit using dollars to settle accounts between themselves. Manipulated economic statistics like the Consumer Price Index provide the illusion that inflation is lower than it really is. Manipulation of prices for gold and silver provide the illusion that the dollar is stronger than it really is. The only way to save the currency is to dump the debt. Imagine not paying all that interest!

The interest alone will overtake tax revenues when interest rates begin to climb. Ronald Reagan’s Grace Commission labeled this a Debt Trap: “100% of what is collected is absorbed solely by interest on the Federal Debt ... all individual income tax revenues are gone before one nickel is spent on the services taxpayers expect from government.” The system literally depends on the creation of ever greater debt loads in perpetuity, and if new borrowers cannot be enticed into taking out loans, the whole economy collapses — leaving the bankers in control of everything (plus interest).

Repudiation Detriments

These detriments may be a blessing.

1. Government's Inability to Borrow This is a detriment? No, it is the only way the people will regain control of their government. Good projects with solid pay-back will still get funded, and with less competition from wasteful unconstitutional "programs" to buy votes.

American military protecting foreign interests on foreign soil will have to come home and protect our own borders.

Wars will need consensus from taxpayers who pay the bills TODAY, instead of passing costs to the next generation.

2. Social Programs will suffer. You get the government you deserve. Social Security and Medicare were conceived as an underhanded way to raise immediate revenues with lavish promises of future benefits. The money was never in a "lockbox" or insurance fund. As a society, voters allowed their government to spend beyond its means. The money is GONE because voters allowed themselves to be deluded and deceived.

Going forward, current workers will have to pay the prior generation's benefits to the extent they can. The population demographics no longer support accumulation of a nest egg to fund future payments. What is the difference whether Social Security taxes workers directly, or we tax those same workers to pay the national debt which then passes the obligation to Social Security? It is a pass-thru. You just eliminate a middleman by eliminating the debt.

Market Forces Impose Discipline

This time, maybe everyone will learn the lesson not to lend to rogue governments. It is not productive and gives politicians the ability to make promises without paying for them. If people worldwide learn not to regard governments as trustworthy borrowers with the highest credit rating, investors would be much more diligent about looking into the underlying prospects for getting repaid.

Highways, for instance, pledge tolls for repayment. Several decades ago, Pennsylvania Bay Bridge Tunnel was struck by a ship and closed. Those bondholders suffered the risk associated with their toll-revenue bonds. That risk is priced into the bond market and forces investors to evaluate a myriad of business factors such as feasibility, planning, stability, management accountability, and ultimately they diversify their investments in case of unforeseen events like a ship striking the bridge. If borrowers can convince investors that risk is minimal, the risk component of the interest rate will shrink, which allows more borrowing. If investors are not convinced, bad projects will likely go unfunded because thousands of investors made decisions to impose that market discipline. A free market automatically imposes discipline, assuring that money flows to the best projects so long as government does not interfere with the mechanism by guaranteeing a poor risk. We can curb government's ability to interfere with private market discipline by removing its unfettered ability to borrow.

What Caused the Collapse

All investments are a tradeoff of risks versus rewards. Every loan (bond, note, bill) comes with a risk of non-repayment and loss. Some loans carry the additional risk of revolution, especially regarding emerging and communist countries. Fools worldwide bought government debt knowing the risks, now let them suffer the consequences. They contributed to our decline, now let them share the consequences of our joint folly rather than foisting the consequences on diligent savers in the form of inflation.

Likewise, fools who bought shares of Fannie Mae and Freddie Mac should have investigated and known those quasi-government entities were buying toxic loans lenders would not dare hold in their own portfolios. The Ruling Class (notably Bill Clinton, Chris Dodd, and Barney Frank, and CONgress) passed the Community Reinvestment Act that "forced" and cajoled banks into making loans to people who had not EARNED the right to borrow large amounts of money. Some lenders (notably PHH Mortgage which then rocketed up to seventh largest lender operating under Coldwell Banker and other private labels) rebelled. How they managed to resist government's intense political and legal pressure is a subject for another analysis, but the point is – they DID resist making sub-prime loans. PHH and a number of local community banks followed time-tested good-stewardship banking practices requiring borrowers to prove sufficient discipline and resources to repay the loans. Unfortunately, the foreclosure snowball crushed some of their borrowers too, but their portfolio and their serviced loans remain in far better shape than those of the complicit lenders, like Countrywide, Bank of America, Chase, etc.

The complicit lenders would not have made liar-loans, signature loans, 106% loans, loans characterizing welfare payments as income, and other risky loans except for CONgress enabling them to sell the bad risk to Fannie & Freddie and retain servicing revenues. When politically-favored domestic and foreign banks still got caught with bad loans and worthless derivatives (bets), the Federal Reserve bought their garbage (toxic assets) and illicitly created fiat money to pay for it. Why reward losers by buying their mistakes? Chairman Ben Bernanke stonewalled our elected representative's efforts to know who got the money. See testimony here and here.

Crooked politicians exploited the financial crisis to steal public-money for their banking and corporate cronies. Government enabled bad ethics to drive good ethics out of the marketplace by making the bad loans more short-term profitable than good ones. And did you notice how some of the largest investment houses got instant bank charters within days of the October 2008 crash? The process usually takes years, and is very bureaucratic. But instant charters created instant liquidity ($50 for each $1 in equity) and put the cronies under the protective wing of the Federal Reserve, the cabal of private bankers who took charge of our money in 1913 against the warnings of our constitutional founding fathers never to let that happen.

It goes against American's ethical principles to "stiff" a lender, but WE did not borrow the money, the Ruling Class Progressives, (a bunch of un-convicted felons) did, and we CANNOT pay it back. There are only 3 alternatives:

-

Inflate the currency which penalizes all responsible savers. Inflation stiffs the lenders, but over a longer period of several years as the principal is eroded away.

-

Force our children and grandchildren to pay it back, ensuring that the smart ones will move overseas to avoid the burden, causing a brain-drain and depleting the U.S. gene pool

-

Repudiate the debt NOW and start again with renewed commitment to longstanding constitutional constraints on borrowing, based on accountability.

Projections of debt payments naively assume today's low interest rates. When lenders see inflation coming, rates will rocket upward and a vicious cycle of interest hikes will overwhelm the federal budget. Unless we default on the debt, the interest alone will wipe out the entire U.S. budget and most of our freedom, national assets, and brightest minds will disappear overseas.

Derivatives

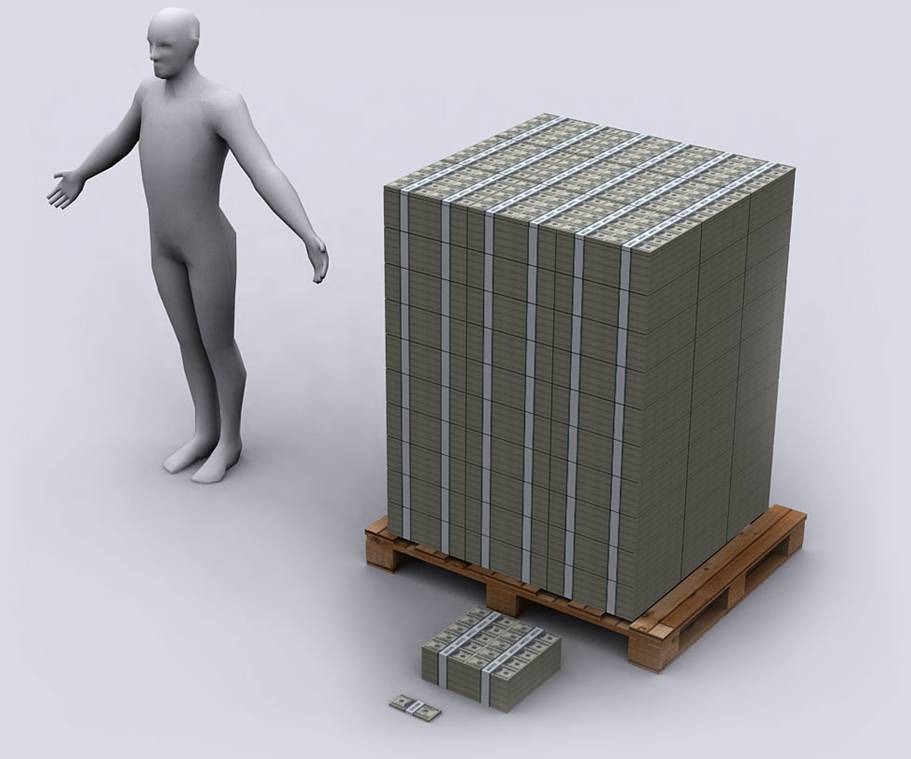

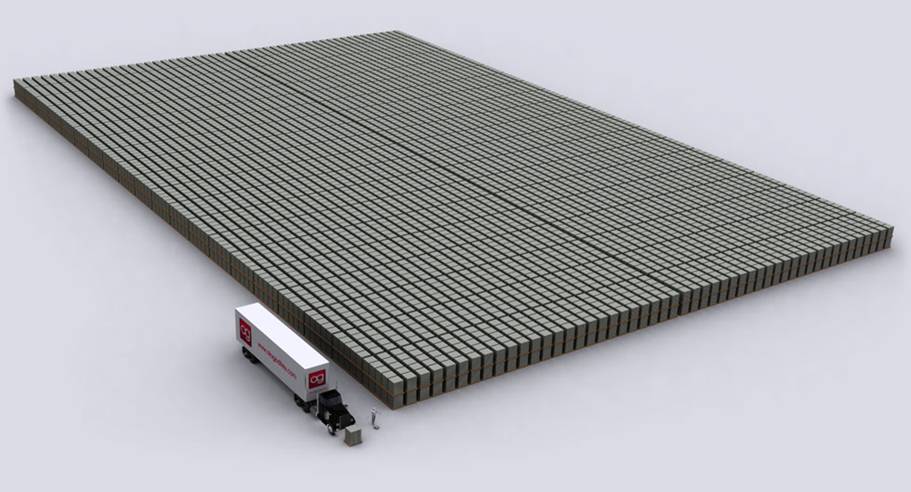

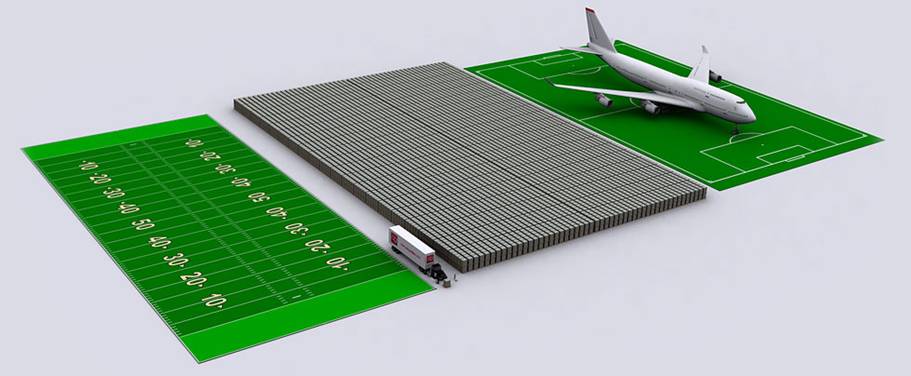

No financial solution is complete without recognizing the 800lb gorilla in the room. Billionaire financier Warren Buffett's 2002 letter to his shareholders said "...derivatives are financial weapons of mass destruction, carrying dangers that, while now latent, are potentially lethal." Bank of International Settlements world derivatives valuation back in 2002 was about $100 trillion. For perspective, consider these numbers in March 2008 prior to collapse:

-

U.S. consumer, mortgage, and government debt $40trillion

-

World's GDPs for all nations approximately $50 trillion

-

Total value of the world's real estate estimated at $75 trillion

-

BIS 2007 valuation of the world's derivatives was a whopping $516 trillion

THAT is a bubble! Financier Bill Gross and others say the real problem is that derivatives were a new way of creating money outside the normal central bank liquidity rules. It allowed huge bets to be carried on the books as assets – with nothing but promises to back them up. Wonder why credit is locked up? What bank is going to lend on a financial statement full of fluff?

This whole BETTING mentality is counter-productive. It diverts resources away from INVESTING in productive endeavors. Secondarily, anything that shifts risk to someone else (like insurance) leads to irresponsible behavior (lending on bad mortgages) and so it happened. Then the Fed stepped in and bought the bad bets from some of its favorite banks and investment firms with fiat money. When the bet goes bad taxpayers lose, when the bet goes well, but the losing counterparty can't pay, taxpayers lose, but the Ruling Class never loses. They reward themselves, pass losses to taxpayers, and avoid the punishments of capitalism.

Derivatives provided false liquidity that fueled the real estate bubble by transferring risk to professional financiers who got rich on fantasy bookkeeping. We cannot support bailing out Chinese, Middle Eastern, or ANY investors who foolishly bought toxic mortgages, or bet on worthless derivatives like they were tulip bulbs in 1637! Remember – until we write down $500Trillion in worldwide DERIVATIVES (bets) from suckers’ balance sheets, every other "remedy" is just dancing around the problem.

When business and government collude, the consequences of greed-driven mistakes are postponed through subsidies, insurance, corporate welfare, and bailouts. This unconstitutional collusion encourages even more arrogance and hubris until the colluders are forcibly separated by the brutal discipline of market forces. Taxpayers should not bail out anyone caught making risky bets that failed. Recovery will only get underway when we develop the honesty to pop the derivatives bubble, value derivatives at their true market value, AND repudiate the taxpayer burden the Ruling Class laid on us to bail out companies who made bad bets. Then shrink the money supply by the amount dumped on the market to surreptitiously buy those toxic assets from worldwide financiers in the Ruling Class. A revitalized honest economy will establish realistic levels of credit focused on BUSINESS lending that creates jobs.

WE THE PEOPLE still wield the ultimate power in this corrupt Republic – but we must use it. Every patriotic American can influence the outcome of this battle just by:

- recruiting friends to view, like, and link to this page

- engaging in this serious discussion about defaulting on the debt, and blogging.

Lenders and politicians will protest that default is irresponsible and will conjure fear of dire consequences. They will do anything to prevent us patriots from taking back our country and sending them to ruin. But ANY discussion which popularizes default will generate the respect needed to reduce politicians ability to borrow to feed their unconstitutional spending addiction. Please join our army and fight to save the once-free U.S. from the communist/progressive destruction planned by Lenin in 1910. The pen is mightier than the sword. Please use yours.

If you appreciate this article

thank us by clicking

|

Washington schemes reward foolhardy business decisions at the expense of good stewards who are entitled to prosper when the foolish fail.

We refuse to support any bailout or “stimulus” schemes because they are unconstitutional, and against the long-term best interest of the country. They distort the free market and encourage the wrong behaviors and decisions. Corporate welfare, bail-outs, and incentives are anti-competitive. They destroy natural market incentives for doing what works and provide perverse incentives for dishonesty.. We do not support extracting $8k of taxpayer money from one class of citizens to give to another as a tax credit for buying a house. It is bad policy and against the constitution to do these things. It is WRONG!!! Politicians stole from YOU, your children, and grandchildren to corrupt the free market toward their selfish political goals, frequently packaged as laudable social goals. As the Fed recently admitted, we are not just bailing out banks, we are bailing out foreigners with future American tax dollars! Banks, and others, are not cleaning up their messes because the natural process of cleansing the shoreline with the ebb and flow of economic tides is now thwarted by the Ruling Class who, as articulated by Obama, believe that markets are vehicles for gaming, not growing. You can fool some of the sheeple most of the time, and most of the sheeple some of the time, but this mess has destroyed the economy of the once-free U.S. and we will not stand by and let CONgress participate in this manipulation. Progressives cannot spend us into prosperity; and inflating us out of their massive fraud is surreptitious theft against saver/investors. The Chinese and Middle East are going to eat our lunch and pop the bag. They valued education, while we slipped to last place among 40 nations by deluding ourselves into complacency. They own our debt, so now they expect to call the tune we’ll dance to. We are no longer masters of our destiny, and together with the communist “Progressives” in CONgress, the Administration and the courts have turned their backs on our Christian nation, and its constitutional protections of God-given rights which begat American Exceptionalism. They are about to trade our heritage for one world currency and domination by an oligarchy.

|

©

2010-2013 Richard Webb 321-480-5514 ©

2010-2013 Richard Webb 321-480-5514

eMail Richard URL: http://4Brevard.com/tyranny/repudiate.htm

Last Modified

|

If you appreciate this article |